- The crypto market capitalization has increased slightly in the last 24 hours.

- The increase in the price of BTC and ETH contributed to the increase in the market cap.

The cryptocurrency market recently experienced a slight increase in market capitalization. This growth was mainly driven by Bitcoin prices [BTC] and Ethereum [ETH]which dominate the market.

Additionally, both assets have experienced significant volume accumulation recently.

Bitcoin, Ethereum contribute to market growth

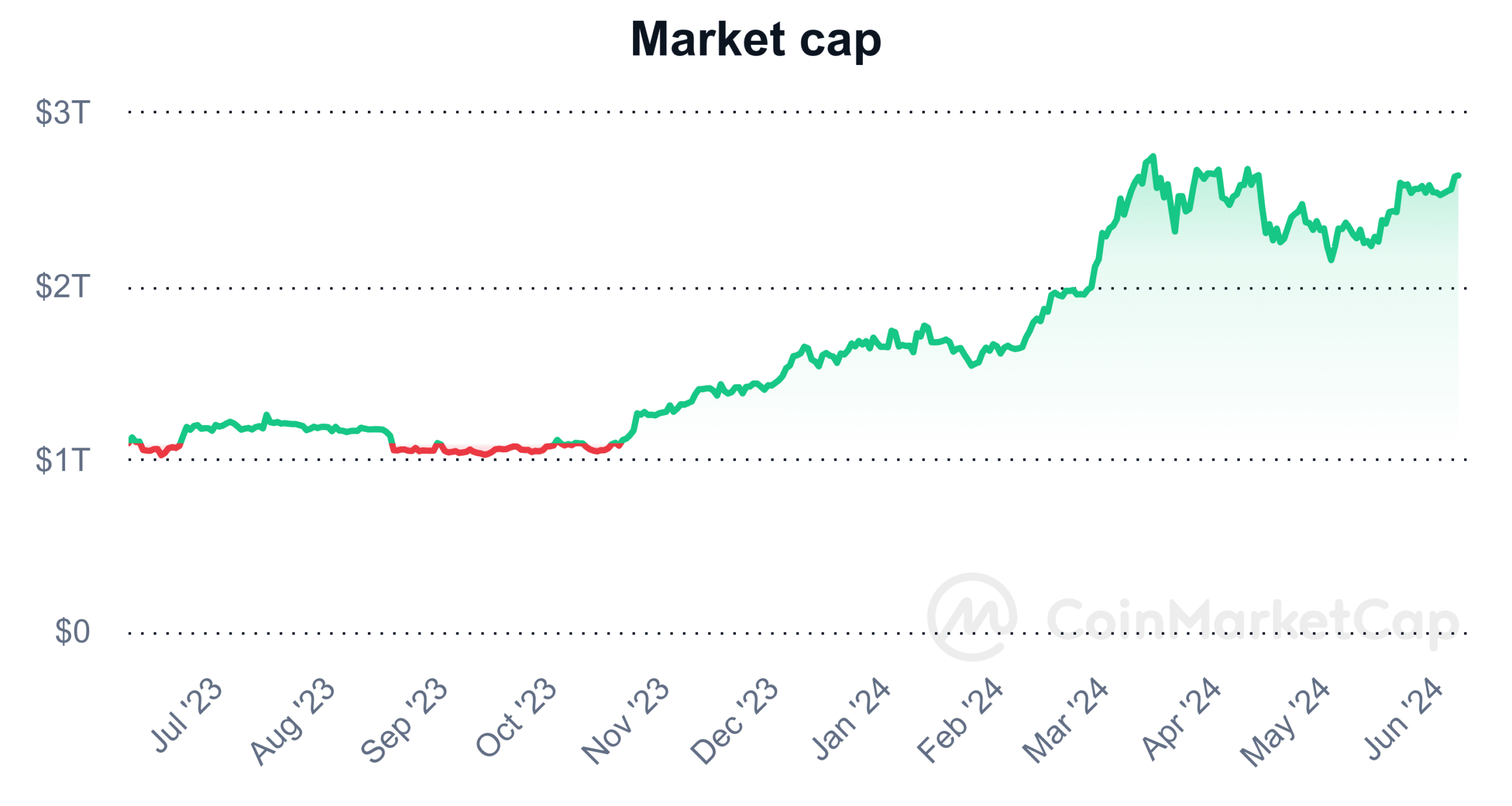

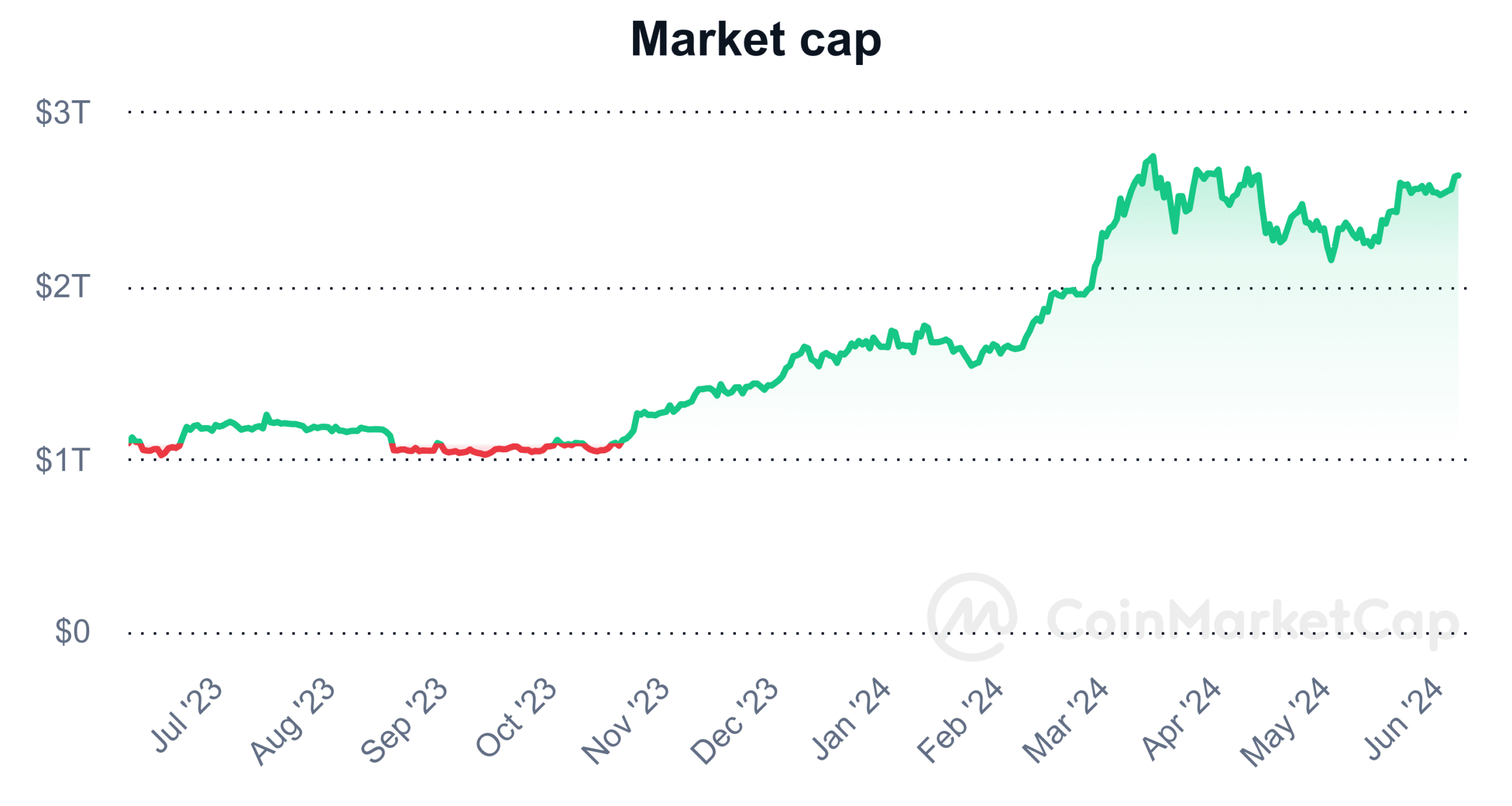

According to data from CoinMarketCap, the cryptocurrency market capitalization has increased by over 1% in the last 24 hours.

Currently, the market capitalization stands at over $2.6 trillion. The analysis revealed that Bitcoin accounts for over 53% of the market cap, amounting to around $1.4 trillion, while Ethereum holds nearly 18%, worth around $463 billion.

Source: CoinMarketCap

Further analysis revealed that the market capitalization increased by almost $1 trillion from the end of last month until now.

At the end of May, the market cap was approximately $1.54 trillion. Currently, it stands at around $2.54 trillion, an increase of nearly $1 trillion.

Bitcoin, Ethereum See Accumulation Rise

Recent analysis shows an increase in the accumulation of Bitcoin and Ethereum over the past few days. This accumulation coincides with visible price movements, contributing to the growth of market capitalization.

According to data from CryptoQuant, wallet holdings holding between 1,000 and 10,000 Bitcoins have increased.

These wallets now collectively hold over 3.6 million BTC, showing a significant accumulation despite recent price fluctuations.

Further analysis showed that this trend has continued since March. Furthermore, wallets in the 1000 BTC category now account for about 40% of the total Bitcoin supply.

Furthermore, the data shows that Ethereum has experienced increased accumulation from large addresses.

The chart reveals an upward trend in accumulation from wallets holding between 10,000 and 100,000 ETH. These addresses now hold over 340,000 ETH, worth more than $1.3 billion.

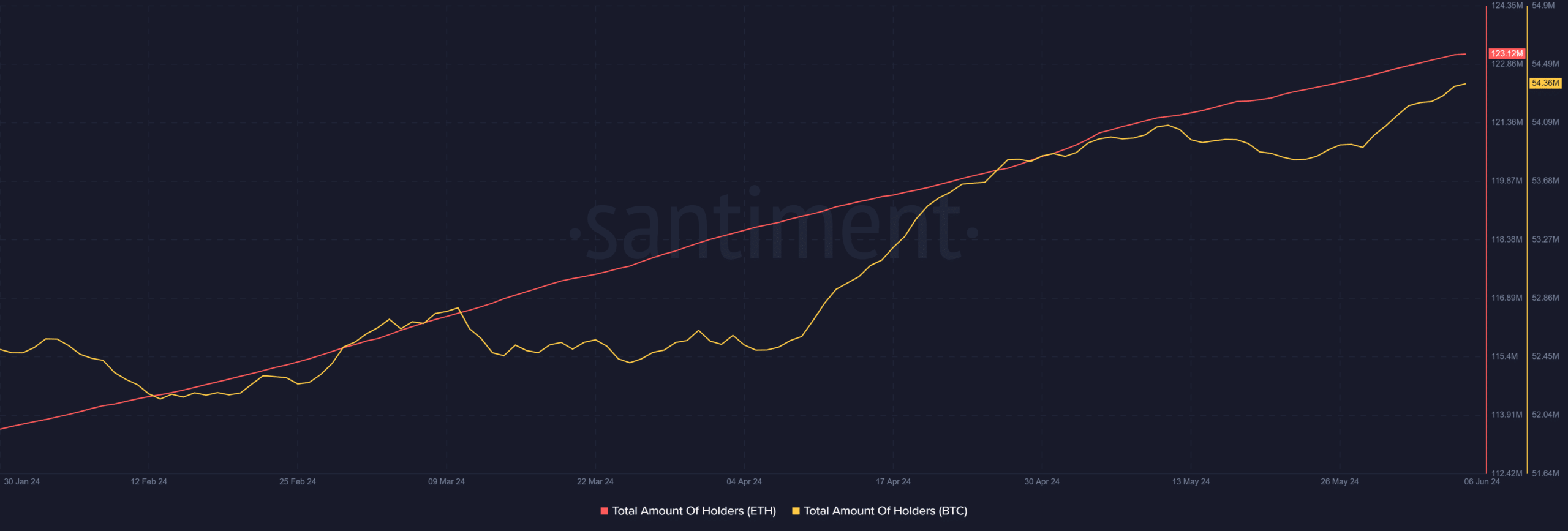

Ethereum sees more holders than Bitcoin

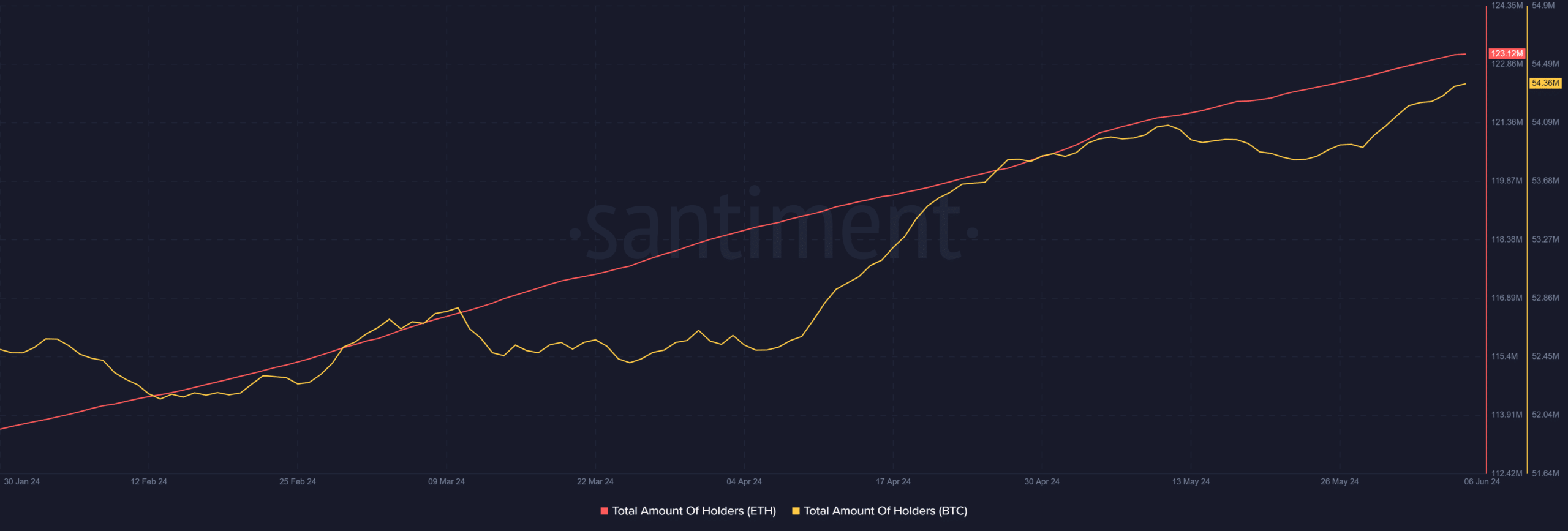

Bitcoin and Ethereum have both experienced increases in accumulation, but Ethereum currently has more holders.

According to data from Santiment, the number of Ethereum holders has increased in recent years, reaching nearly 123 million. In contrast, the number of Bitcoin holders stands at around 54.2 million.

Source: Sentiment

This shows that the number of Ethereum holders is more than double the number of Bitcoin holders. A major reason for this may be the cost of access to these assets.

Currently, the value of Bitcoin has increased again, with predictions of further increases in the future.

This increase may push more traders towards alternative assets like Ethereum and others, subsequently affecting the prices of these assets.

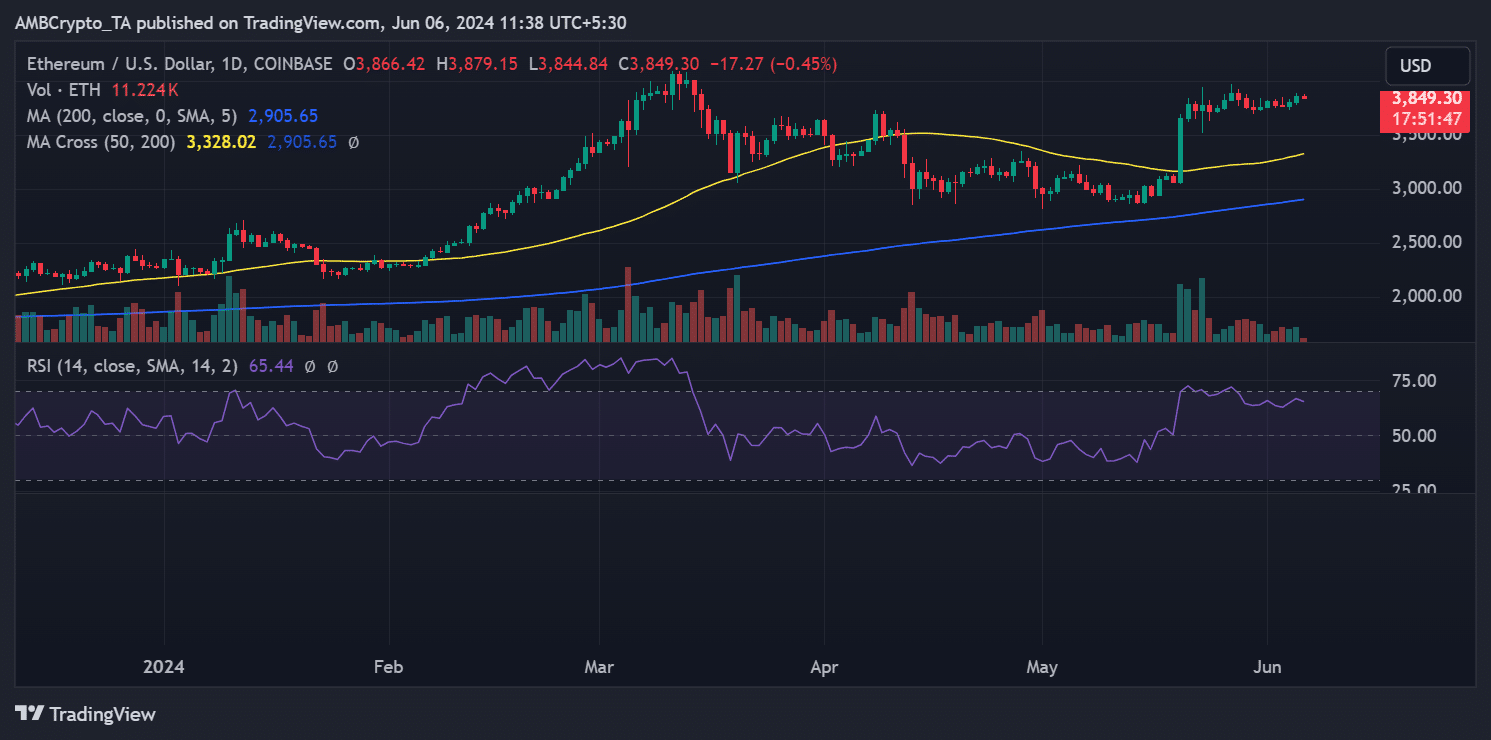

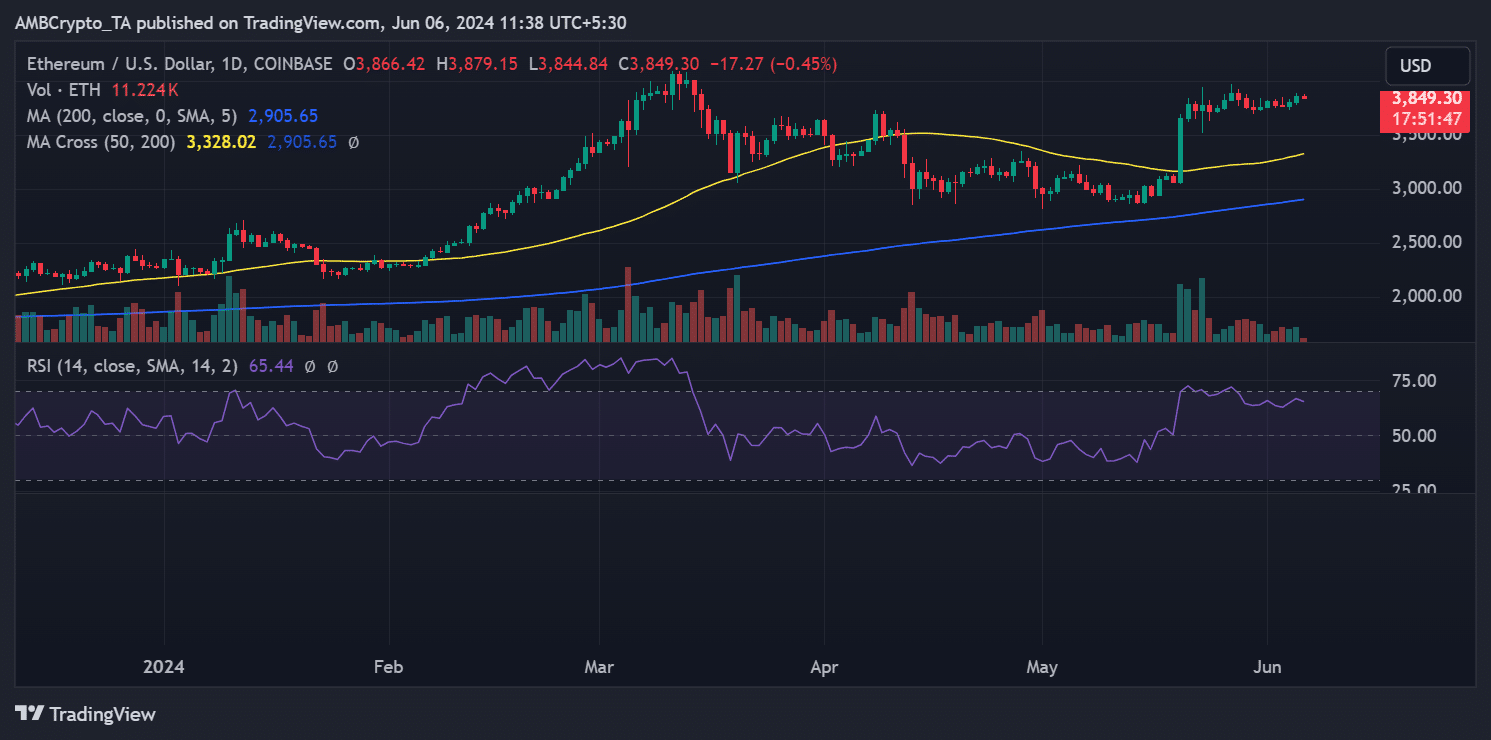

How ETH, BTC have performed in the last 24 hours

AMBCrypto’s daily analysis of Ethereum revealed a positive price movement on June 5, with an increase of 1.48%, taking its price to around $3,866.

Despite recent struggles, Ethereum has managed to stay within this price range. As of this writing, it is still trading in the $3,800 range, down less than 1%.

Source: TradingView

Additionally, an analysis of Ethereum’s Relative Strength Index (RSI) showed that it remains in a strong uptrend. As of this writing, its RSI is above 65.

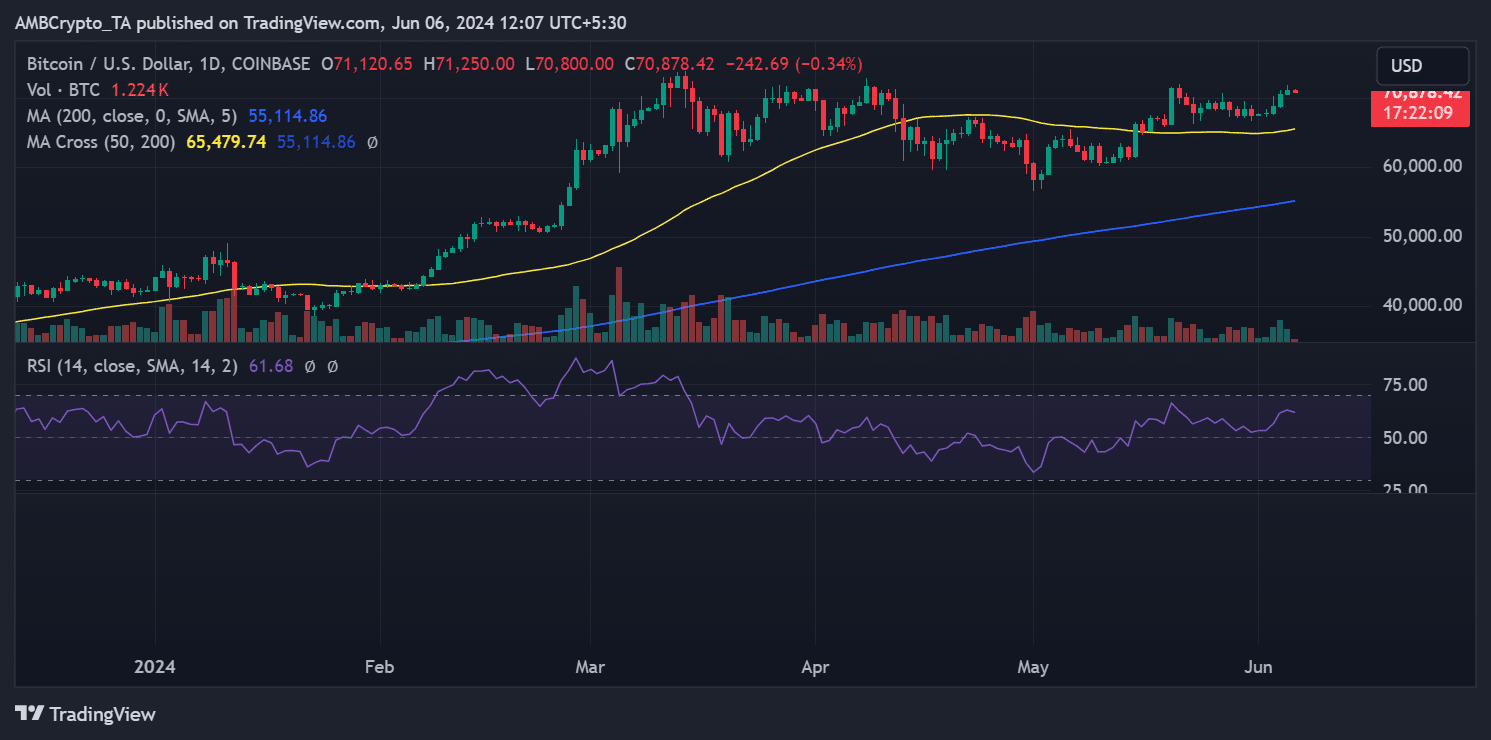

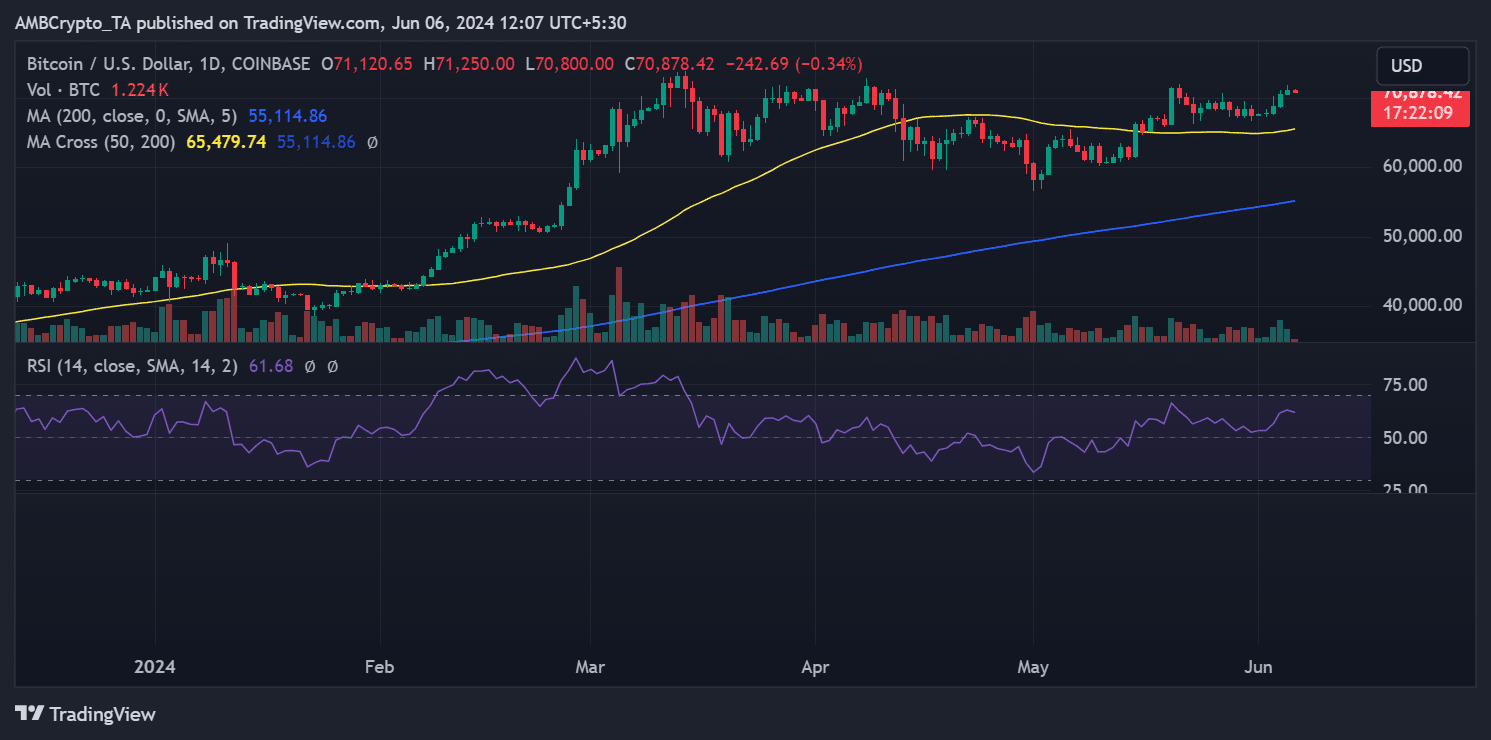

Bitcoin price trend analysis showed positive growth over the past few days. The chart showed a five-day straight rally, taking its price from around $67,700 to over $71,000.

Source: TradingView

Read Bitcoin (BTC) Price Forecast 2024-2025

By the close of trading on June 5, Bitcoin was trading at around $71,121, up nearly 1%. As of this writing, it has dipped slightly into the $70,000 region, down less than 1%.

According to its RSI, BTC remained in an uptrend despite the recent price decline. The RSI was above 60 as of this writing.